Keltner Channel Strategy Mastering Trading on Pocket Option

The Keltner Channel strategy is gaining popularity among traders who use the Pocket Option platform. This technique combines price action with volatility, providing traders with a unique perspective on market movements. Understanding how to implement the Keltner Channel effectively can significantly improve your trading skills. For more resources and tools, check out keltner channel strategy pocket option https://pocketopt1on.com/fr/application/.

Understanding the Keltner Channel

The Keltner Channel is a volatility-based envelope indicator that sets up buy and sell signals. It consists of three lines: a middle exponential moving average (EMA), and two outer bands that are typically set at a multiplier of the Average True Range (ATR). The outer bands serve as resistance and support levels, while the EMA indicates the trend’s general direction. When used correctly, this strategy can help to identify potential entry and exit points.

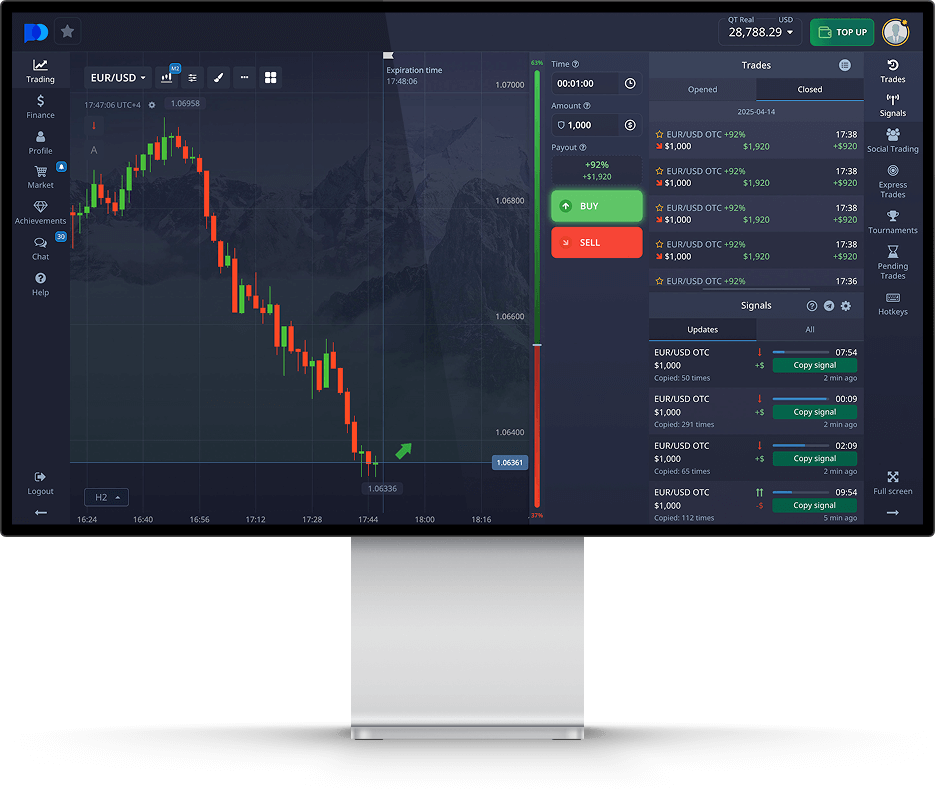

Setting Up the Keltner Channel on Pocket Option

Setting up the Keltner Channel on the Pocket Option is straightforward. Begin by logging into your account and selecting your preferred asset. Then, navigate to the indicators section and add the Keltner Channel. Configure the settings to your trading style, commonly using a 20-period EMA for the center line and ATR settings for the bands. The default multiplier is usually set at 1.5, but this can be adjusted based on market behavior or personal preference.

Key Components of the Keltner Channel

Understanding the components of the Keltner Channel is essential for effective trading:

- Center Line (EMA): This line acts as the baseline for identifying the trend. If prices are above the EMA, it typically indicates a bullish trend, while prices below suggest a bearish trend.

- Upper Band: The upper band helps determine overbought conditions. When the price touches or breaks this level, it may signal a potential reversal.

- Lower Band: Conversely, the lower band indicates oversold conditions. A price bounce from this level might suggest a potential upward move.

Trading Strategy Using Keltner Channels

Using the Keltner Channel effectively requires knowledge of market conditions and trading psychology. Here are a few strategies that can be executed on Pocket Option:

1. Trend-following Strategy

When the price remains above the EMA and frequently touches the upper band, consider this an indication of a strong uptrend. Traders can look for long positions. Conversely, if the price is below the EMA and frequently touches the lower band, this signals a downtrend, prompting short positions.

2. Reversal Strategy

Traders may also consider entering positions when the price breaks through the outer bands. For example, if the price exceeds the upper band, this could imply overbought conditions, warranting a short position. Conversely, if the price falls below the lower band, it may imply oversold conditions, suggesting a long entry.

3. Bounce Strategy

The bounce strategy involves trading when the price hits one of the bands. If the price retraces from the upper band, traders may enter sell positions. If the price bounces from the lower band, long positions can be initiated.

Risk Management

No trading strategy is 100% effective, which is why risk management is crucial. Determine your stop-loss levels based on the volatility of the asset and the Keltner Channel’s bands. A common approach is to set a stop-loss slightly beyond the opposite band to protect your capital in case of price movement against your position.

Benefits of the Keltner Channel

The Keltner Channel offers several advantages for traders on the Pocket Option platform:

- Visual Clarity: The channel provides a clear visual representation of the market’s volatility and trend, making it easier for traders to make informed decisions.

- Flexibility: This strategy can be applied to various trading styles, from short-term scalping to long-term investing.

- Combines Multiple Indicators: The integration of the EMA and ATR provides a comprehensive overview of market conditions.

Potential Drawbacks

While the Keltner Channel strategy is powerful, it also has its limitations:

- Lagging Indicator: As a trend-following strategy, it may provide late signals, causing traders to miss optimal entry points.

- False Signals: In choppy or sideways markets, the Keltner Channel may produce false breakouts, potentially leading to losses.

Conclusion

In conclusion, the Keltner Channel strategy offers a robust framework for trading on Pocket Option. By understanding its components, setting it up correctly, and employing sound trading and risk management strategies, traders can enhance their trading performance. As with any trading strategy, continuous learning and adaptation to market conditions are essential for long-term success. Start applying the Keltner Channel in your Pocket Option trading to experience its benefits firsthand!